The Nepal Stock Exchange (NEPSE) witnessed a sharp decline of 58.55 points on Monday, the first trading day after the Dashain holidays. The market experienced heavy losses following the recent GenZ movement, which has shaken investor confidence.

After closing at 2,662.51 points before Dashain, the NEPSE index dropped to 2,604.96 points, marking a 2.19% decline. Trading volume also decreased significantly, with transactions worth Rs 4.62 billion recorded. Prices of 235 companies fell, while only 16 companies saw gains. Bhugol Energy Development Company’s share price declined the most, plunging 9.99%.

All sectoral sub-indices ended in the red. Despite the drop, investors remain cautiously optimistic about a rebound in the near future.

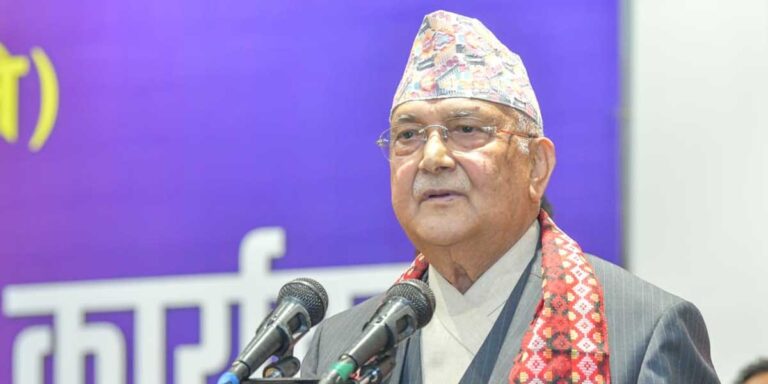

According to Chhote Lal Rauniyar, former president of the Nepal Investment Forum, the market is expected to regain momentum after the first review of the monetary policy.

He attributed the current volatility to the uncertainty caused by the GenZ movement, political instability, and doubts about the upcoming elections. “Investor morale has been shaken, and the market is reacting to the uncertainty,” he said.

Rauniyar added that the delay in submitting recommendations from the Capital Market Reform Committee under the Ministry of Finance has also affected market sentiment. However, once the committee presents its suggestions, the market could see some relief.

He further expressed optimism that the revised monetary policy may include positive provisions such as allowing banks to invest more actively in the stock market and lifting the Rs 250 million investment cap.

“The market has already dropped significantly and there’s little room left for further decline. Liquidity is high, and interest rates are low—conditions that favor market growth,” Rauniyar said.

“Therefore, I advise investors to hold their positions for now,” he added.